Don’t Miss Out On How To Maximize Social Security Benefits While Working

In today’s every-changing economic landscape, many individuals are seeking to optimize their financial strategies to ensure a secure retirement while also maintaining employment. One common concern is whether it’s possible to continue working and still collect Social Security benefits. In this guide, we delve deep into this topic, providing clarity and actionable insights to help you make informed decisions regarding your Social Security benefits and employment status.

Understanding the Basics

Before getting into the intricacies, let’s establish a fundamental understanding of how Social Security benefits work. Social Security is a government program designed to provide financial assistance to retirees, disabled individuals, and survivors. The amount of benefits you receive is primarily based on your earnings history and the age at which you choose to start receiving benefits.

Working and Collecting Social Security

Contrary to popular belief, it is indeed possible to work and collect Social Security benefits simultaneously. However, there are certain factors to consider, such as your age and income level, which can impact the amount of benefits you receive. Let’s explore these factors in detail:

Full Retirement Age (FRA)

Your Full Retirement Age (FRA) is the age at which you are entitled to receive full Social Security benefits. This age varies depending on the year you were born. For example, if you were born in 1960 or later, your FRA is 67. If you choose to collect benefits before reaching your FRA, your benefits may be subject to reduction.

Earnings Limit

If you choose to work while receiving Social Security benefits before reaching your FRA, there is an earnings limit imposed by the Social Security Administration (SSA). For 2024, the earnings limit is $19,560 per year, or $1,630 per month. If your income exceeds this limit, your benefits may be reduced by $1 for every $2 earned above the threshold.

Delayed Retirement Credits

On the flip side, if you choose to delay collecting Social Security benefits past your FRA, you may be eligible for delayed retirement credits. For each year you delay benefits beyond your FRA, up until age 70, your benefit amount increases by a certain percentage. This can result in higher monthly benefits once you do start collecting.

Strategic Considerations

To maximize your Social Security benefits while working, consider the following strategies:

Delay Benefits if Possible

If your financial situation allows, delaying Social Security benefits beyond your FRA can result in higher monthly payments in the future. This can be particularly beneficial if you expect to live longer, or if you want to maximize survivor benefits for your spouse.

Plan Your Income

If you’re still working and receiving Social Security benefits, carefully plan your income to stay within the earnings limit. Consider reducing your work hours or adjusting your investment portfolio to minimize income while still maintaining financial stability.

Coordinate with Spouse

If you’re married, coordinate with your spouse to maximize your combined Social Security benefits. This may involve strategic decisions such as one spouse claiming benefits early while the other delays, or both spouses delaying benefits to maximize survivor benefits.

The Takeaway

In conclusion, working and collecting Social Security benefits simultaneously is indeed possible, but it requires careful planning and consideration of various factors. By understanding your Full Retirement Age, the earnings limit, and strategic planning strategies, you can maximize your benefits and secure a financially stable retirement. Remember to consult with a financial advisor or Social Security expert to tailor a plan that best suits your individual needs and circumstances. The best way to do this is to go to a Social Security office and sit with someone in person, if possible.

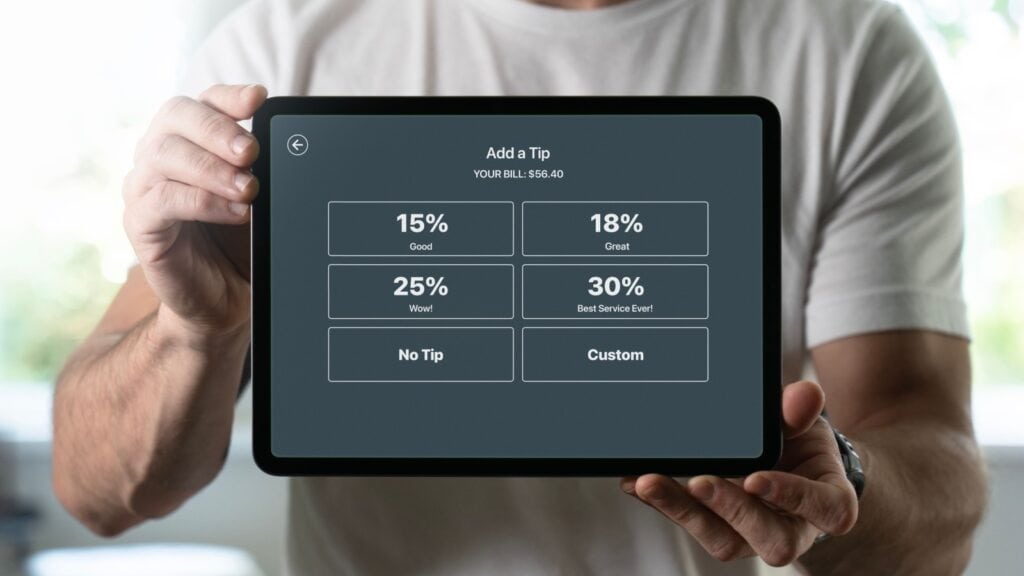

Are We Getting Bullied Into Tipping? When To, How Much And When Not To Tip

It is happening more and more. You are standing in line at a fast food restaurant or coffee shop,… READ ARTICLE HERE.

9 Of The Most Regretted Purchases People Still Regularly Make

Many people regret trying to keep up with the latest trends, whether it’s buying expensive fashion items, fancy gadgets… READ MORE HERE

Join Us

Join us on this empowering journey as we explore, celebrate, and elevate “her story.” The Queen Zone is not just a platform; it’s a community where women from all walks of life can come together, share their experiences, and inspire one another. Welcome to a space where the female experience takes center stage. Sign up for our newsletter so you don’t miss a thing, Queen!