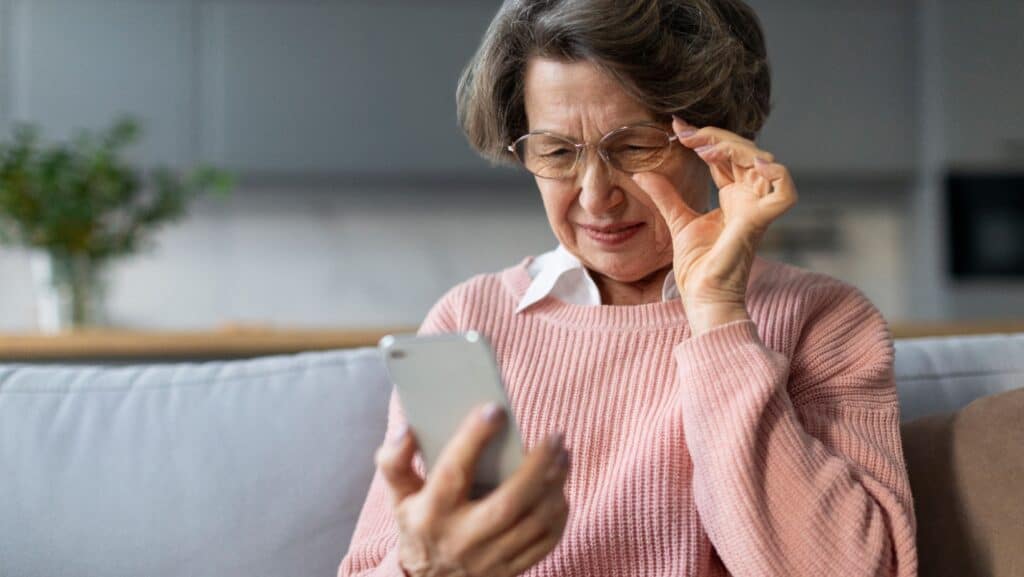

10 scams targeting seniors on Facebook right now

Facebook has become a high-stakes hunting ground where organized scammers are zeroing in on seniors, and billions of dollars in retirement savings are now at stake.

Facebook has become a digital town square where we catch up with old friends and share photos of the grandkids, but it also attracts thieves looking for an easy mark. Scammers see the platform as a hunting ground because it is full of trusting folks who might not spot a digital con until their bank account is empty.

You need to know exactly what these traps look like so you can protect your hard-earned savings from criminals who want to steal your peace of mind.

The AI Grandchild Emergency

This frightening trick uses artificial intelligence to clone a loved one’s voice, making a frantic call sound exactly like your grandchild in trouble. The voice on the other end begs you to send bail money or wire cash for a hospital bill immediately, without telling mom or dad. Scammers use audio clips from Facebook videos to train AI programs to perfectly mimic the voices of your family members.

The urgency is designed to make you panic, so you act quickly without verifying the story with other relatives first. If you get a call like this, hang up immediately and call your grandchild or their parents on a known number to check if they are actually safe.

The Phantom Romance Trap

Romance scammers build fake relationships over weeks or months to gain your trust before asking for money to solve a sudden fake crisis. They often steal photos from real soldiers or doctors to create a believable persona that sweeps you off your feet. Webster First says the FTC reports that 70% of people contacted via social media reported financial losses totaling $1.9 billion.

These criminals are patient and will wait until you feel a deep emotional connection before they spring their trap on you. They might claim they need cash for a plane ticket to visit you or for emergency surgery, but the moment you send the funds, they vanish.

The High Return Investment Mirage

Fraudsters flood Facebook feeds with ads for “guaranteed” investment opportunities that promise to double your retirement savings in days. They use fake celebrity endorsements or fabricated testimonials to make the scheme appear legitimate and to build wealth quickly. Investment scams were the most lucrative category in 2024, costing victims a staggering $5.7 billion in losses.

These schemes often push cryptocurrency or gold, playing on the fear of missing out on the next big financial boom. Once you transfer your money into their fake platform, the numbers on the screen go up, but you will never be able to withdraw a single cent.

The Marketplace Overpayment Hustle

Selling furniture or old collectibles on Facebook Marketplace can attract buyers who claim to mistakenly send you too much money on apps like Zelle or Venmo. They will ask you to kindly refund the difference, but the initial payment was fake or stolen and will eventually bounce. You end up sending your own real money to the scammer before the bank realizes the original transfer was fraudulent.

They often make excuses for not meeting in person, saying they will send a mover or a cousin to pick up the item instead. Stick to local pickups where you can exchange cash in public, and never accept overpayments from strangers online.

The Friend Request Clone

You might receive a friend request from someone you’ve been friends with for years, claiming they were hacked and had to start over. This imposter copies your friend’s profile photo and bio to trick you into accepting the new request so they can message you. AARP reports that adults over 60 lost nearly $4.9 billion to fraud in 2024, often starting with simple tricks like this.

Once you accept, they will send you malicious links or ask for money, banking on the fact that you trust the person they are pretending to be. Always call or text your friend outside of Facebook to ask if they actually sent a new request before you click accept.

You Won The Lottery Con

These scammers send messages claiming you have won a massive prize from a contest you do not remember entering, often posing as the “Facebook Lottery.” They say the millions are yours, but you must pay a smaller fee for taxes or customs duties to release the funds. The average loss for fraud victims over the age of 60 was $83,000, a devastating blow to anyone living on a fixed income.

Legitimate lotteries and sweepstakes will never ask you to pay money upfront to receive your winnings. If anyone asks you to pay a fee to collect a prize, it is a guaranteed scam, and you should delete the message immediately.

The Look Who Died Phishing Link

A message pops up from a friend’s compromised account with a shocking caption like “I can’t believe he died” or “Is this you in this video?” It includes a link that takes you to a fake Facebook login page designed to steal your password. If you type in your credentials, the hackers instantly gain access to your account and can start scamming your entire friends list.

This curiosity gap is a psychological trick meant to make you click without thinking about the danger. Never click on vague links that seem sensational, even if they appear to come from someone you know and trust.

The Data Harvesting Quiz

Fun quizzes that ask “Which 1950s movie star are you?” or “What was the number one song when you were born?” seem harmless. However, these questions are often designed to elicit answers to common security questions banks use to protect your accounts. By answering these public posts, you are handing over the keys to your digital life to anyone watching.

Scammers collect this information to crack your passwords or reset your login details on other sensitive websites. Avoid participating in these viral questionnaires and never share personal details like your first pet’s name or your mother’s maiden name publicly.

The Tech Support Pop Up

You might see an ad or click a link that triggers a loud alarm on your device, warning you that your computer is infected. A pop-up message will urge you to call a support number, where a fake technician will ask for remote access to “fix” the problem. Older consumers reported $159 million in losses to tech support scams in 2024, often paying for useless services.

These criminals will charge you hundreds of dollars for software you do not need or, worse, install malware to steal your banking info. Real tech companies like Microsoft or Apple will never ask you to call a phone number through a pop-up message on your screen.

The Fake Charity Plea

After a natural disaster or news event, scammers create fake charities or GoFundMe pages that appear to be legitimate relief efforts. They play on your empathy and desire to help those in need, circulating these emotional posts through Facebook groups. Always do your homework on a charity using sites like Charity Navigator before you open your wallet.

The money you donate goes directly into the scammer’s pocket rather than helping the victims of a hurricane or fire. Donating directly through the official website of a major organization is the only way to be certain your money helps the right people.

Like our content? Be sure to follow us