Refinance or Stay Put? The 2026 Mortgage Math Every Homeowner Should Run

Refinancing is worth a fresh look in 2026 because 30‑year mortgage rates have slid back down to the low‑6% range after flirting with 7% last year, but whether you should jump depends on your current rate, how long you’ll stay put, and how the closing costs pencil out for your specific loan.

The information offered here is not to be considered financial advice. Always work with an accredited financial advisor when making important financial decisions.

Where 30‑year rates sit in early 2026

Nationally, the average 30‑year fixed mortgage rate is around 6.1%–6.2% in early February, according to Freddie Mac’s Primary Mortgage Market Survey and Bankrate’s latest lender survey. Freddie Mac reports the 30‑year fixed at 6.11% as of February 5, 2026, down from 6.89% a year ago, while Bankrate puts the average 30‑year fixed APR at 6.22% on February 12. These levels are just above the recent lows of the past year and notably below 2023–2024 peaks that brushed 7% and higher.

The basic “refi math” every homeowner should run

The core question is whether the monthly savings from a lower rate are big enough, and last long enough, to justify the upfront closing costs. Consumer credit bureau Experian notes that refinancing typically costs 2% to 6% of the loan amount in closing costs, which can easily be $8,000–$24,000 on a $400,000 mortgage. To see if a refi makes sense, experts recommend calculating your break‑even point by dividing total closing costs by your expected monthly savings on the new loan.

A simple break‑even example

Say you can drop your payment by $200 a month by refinancing, but you’ll pay $6,000 in closing costs to get that lower rate. Divide $6,000 by $200, and you get 30 months, meaning you need to stay in the home at least two and a half years just to break even on the upfront cost. Experian highlights a similar scenario where a refi saves $131 per month, costs $4,000 to close, and takes about 24 months to reach break‑even before the homeowner starts to see net savings.

When refinancing in 2026 usually makes sense

Refinancing tends to be more compelling when your current rate is meaningfully higher than today’s low‑6% averages and you expect to stay in the home beyond your break‑even period. Even a relatively modest rate cut can generate tens of thousands of dollars in lifetime interest savings, especially if you refinance early in your loan term when most of your payment is going toward interest. In a Bankrate analysis focused on borrowers who are already well into paying off their mortgage, experts say refinancing can still be smart if the break‑even period is roughly two years or less.

What experts say about the “two‑year rule”

Mortgage professionals often use a back‑of‑the‑envelope rule: if you cannot recoup your closing costs within about two years, a refinance may not be worth it. Bankrate quotes Rocke Andrews, former president of the National Association of Mortgage Brokers, saying that for most borrowers, “it’s only worthwhile…if the break‑even period is two years or less,” especially for those who are already far along in their amortization schedule. That rule of thumb pairs with guidance from refinance guides that stress running the numbers for your specific loan amount, rate drop, and timeline rather than chasing headlines about lower rates.

How closing costs change the equation

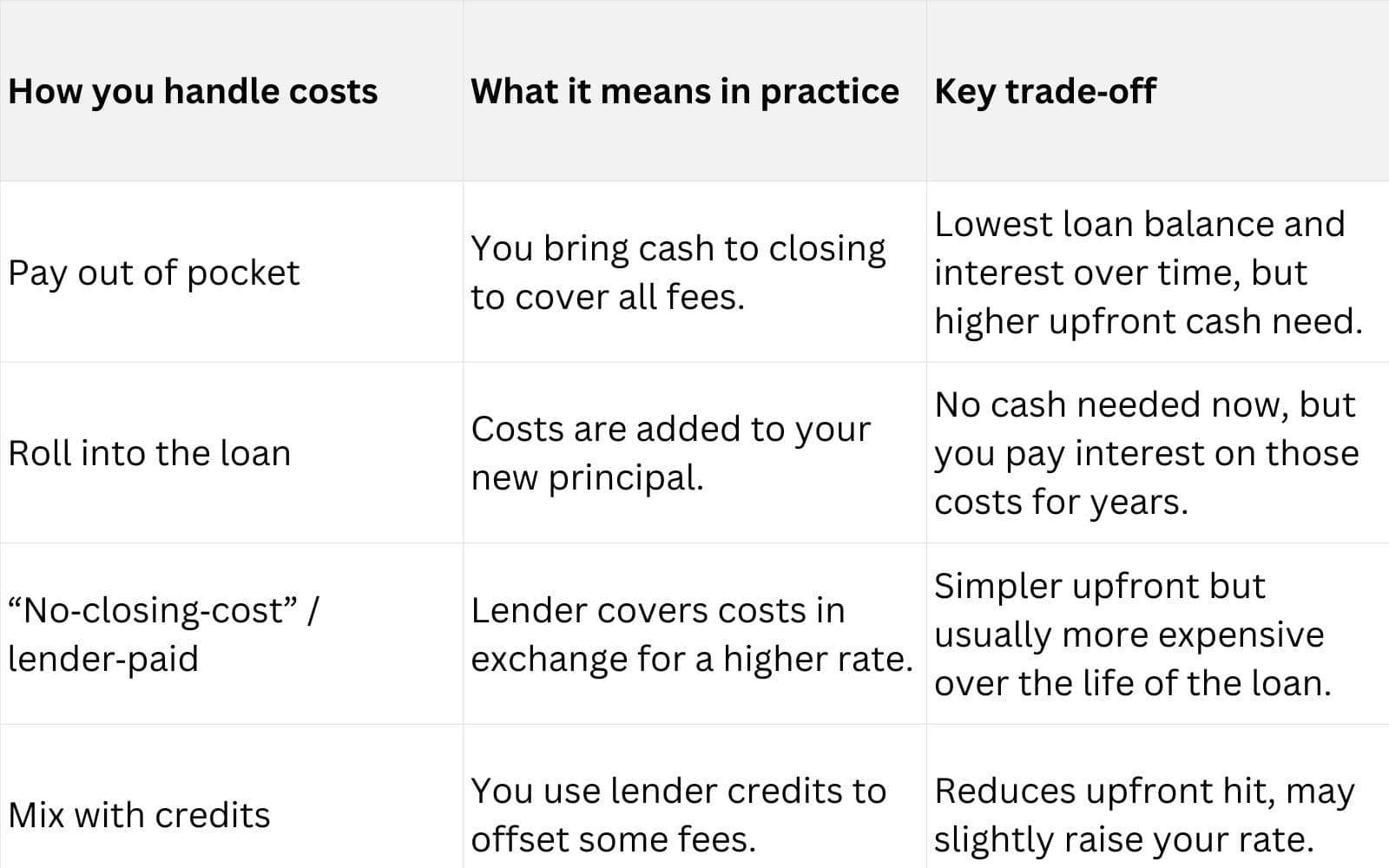

Closing costs don’t just affect your break‑even; how you pay them changes the total cost of your new loan. Experian points out that refinance closing costs cover lender origination, appraisal, title services and more, and that “no‑closing‑cost” loans still make you pay via a higher interest rate or by rolling costs into your balance. A 2026 refinance guide explains that you generally have four options: pay costs out of pocket at closing, add them to the new loan, accept a slightly higher rate in exchange for lender‑paid costs, or use lender credits to offset some fees.

Handling costs: pros and cons at a glance

Situations where staying put often wins

If your current rate is already close to today’s 6%–6.2% range, or you expect to move or sell within a few years, refinancing may not pay off once you factor in closing costs. Experts note that homeowners nearing the end of their mortgage term are often better off making extra principal payments rather than starting a new 30‑year clock, unless a cash‑out refinance fills a specific need. Experian similarly cautions that when closing costs are high relative to your payment savings, the break‑even period can stretch to four or five years or more—longer than many people realistically plan to keep their current mortgage.

Traps to avoid when you refinance

Refinancing in a low‑6% world can save money, but there are several common pitfalls that can quietly erase those savings.

- Extending your term too far: Rolling from, say, year 7 of a 30‑year into a brand‑new 30‑year loan can reduce your payment but increase total interest paid, because you reset the clock.

- Ignoring total interest: Experian emphasizes looking at lifetime interest costs and not just the monthly payment; in some cases, a slightly higher payment for a shorter term (like 15 years) saves far more over time.

- Chasing “no‑closing‑cost” marketing: Refinance guides warn that loans advertised with no upfront costs often bake those costs into a higher rate, which may cost more across decades.

- Refinancing right before a move: Bankrate’s refinance analysis stresses that if you plan to sell before you hit your break‑even point, you never actually benefit from the lower rate.

How to sanity‑check your numbers before deciding

Before you call a lender, it can help to sketch out your own quick refi “stress test” so you’re not starting the conversation from zero. Refinance experts suggest you gather your current balance, rate, remaining term, estimated new rate, and estimated closing costs and then: calculate your new payment, monthly savings, and break‑even month; compare total interest over the remaining life of your current loan versus the proposed refi; and consider how long you realistically expect to stay in the home. If you want a professional second opinion, consumer finance sites recommend asking a lender or housing counselor to walk through multiple scenarios, including keeping your current loan and making extra principal payments instead of refinancing.

Disclosure: This article was developed with the assistance of AI and was subsequently reviewed, revised, and approved by our editorial team.

Like our content? Be sure to follow us on MSN and Newsbreak