Retire Early, Live Fully: Embracing the FIRE Lifestyle for Financial Independence

The FIRE movement emphasizes the pursuit of early retirement by adhering to a lifestyle characterized by frugality, substantial savings, and strategic investments. Participants aim to accumulate enough financial resources to sustainably cover their living expenses without the need for traditional employment.

A Million Is The Goal

Retiring with a million dollars necessitates a thorough understanding of one’s current expenses, future financial obligations, and the impact of inflation. Achieving this goal requires careful budgeting and financial planning to ensure that the accumulated sum can sustain a retirement period that may span several decades.

Maximizing Income Streams

Increasing income streams is fundamental to accelerating progress toward a million-dollar retirement goal. This can be achieved by diversifying income sources, such as seeking promotions or higher-paying job opportunities, starting a side business, or investing in income-generating assets like rental properties or dividend-paying stocks.

The 50/30/20 Budgeting Rule

The 50/30/20 rule is a popular budgeting guideline that suggests allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings and investments. For individuals aiming for early retirement, adjusting this rule to prioritize savings and investments is essential for achieving the desired financial independence.

Frugality is a Choice

Frugality entails making deliberate spending decisions, distinguishing between needs and wants, and prioritizing long-term financial goals over immediate gratification. By adopting a frugal lifestyle, individuals can optimize their savings rate and accelerate their journey toward early retirement.

Investment Strategies

Investing in a diversified portfolio consisting of stocks, bonds, real estate, and other assets is crucial for achieving long-term growth and reaching the million-dollar retirement goal. Starting early, consistently investing, and staying disciplined are key principles of successful investment strategies.

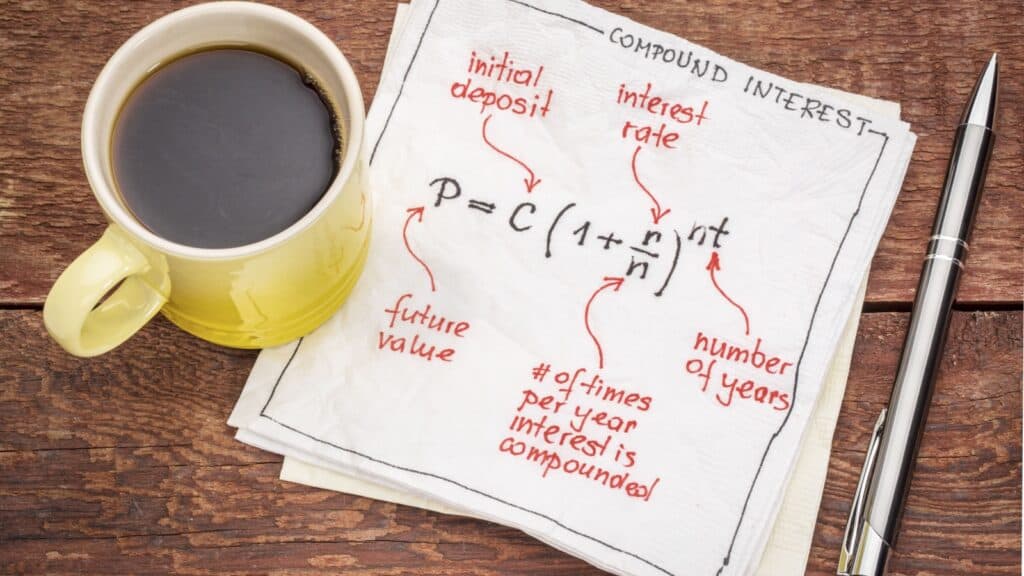

Compound Interest Works for you

Compound interest refers to the exponential growth of savings or investments over time, as earnings generate additional returns. Harnessing the power of compound interest by reinvesting dividends or interest can significantly accelerate wealth accumulation and contribute to achieving early retirement goals.

Know Your Tax-Advantages

Maximizing contributions to tax-advantaged retirement accounts, such as 401(k)s or IRAs, offers tax benefits and accelerates savings growth. These accounts provide opportunities for tax-deferred or tax-free growth, depending on the account type, enhancing the effectiveness of retirement savings strategies.

Live Below Your Means

Living below one’s means involves spending less than what is earned, allowing for a higher savings rate and increased investment contributions. By prioritizing essential expenses and minimizing discretionary spending, individuals can optimize their financial resources and expedite progress toward early retirement.

Manage That Debt

Managing and eliminating high-interest debt is crucial for achieving financial independence and early retirement. Prioritizing debt repayment minimizes interest expenses, freeing up more funds for savings and investments, and accelerating progress toward the million-dollar retirement goal.

Emergency Funds & Insurance

Maintaining an emergency fund and appropriate insurance coverage safeguards against unexpected financial setbacks. An emergency fund provides a financial buffer to cover unforeseen expenses, while insurance policies protect against risks such as medical emergencies or property damage, preserving long-term financial plans.

Education & Career Advancement

Investing in education, skills development, and career advancement opportunities can lead to higher income potential and faster progress toward financial independence. Continuing education and professional growth initiatives enhance earning capabilities and contribute to long-term financial stability.

Real Estate & Passive Income

Investing in real estate properties can generate passive income and provide long-term appreciation potential. Rental income from real estate investments offers a stable income stream, diversifying revenue sources and contributing to financial independence and early retirement goals.

Monitoring & Adjusting Your Financial Plan

Regularly reviewing and adjusting financial plans ensures alignment with changing life circumstances, economic conditions, and investment goals. Periodic reassessment allows for course corrections, optimizing strategies, and maintaining progress toward achieving early retirement objectives.

Discipline & Flexibility

Discipline in financial habits and flexibility in adapting to changing circumstances are essential for achieving early retirement goals. Consistent adherence to savings and investment strategies, coupled with a willingness to adjust plans as needed, ensures resilience and progress toward financial independence.

Values, Goals & Vision

Retirement planning should align with personal values, aspirations, and long-term visions for a fulfilling lifestyle. Establishing clear goals and priorities helps guide decision-making and ensures that financial plans support desired outcomes, whether they involve travel, leisure pursuits, or pursuing meaningful passions in retirement.

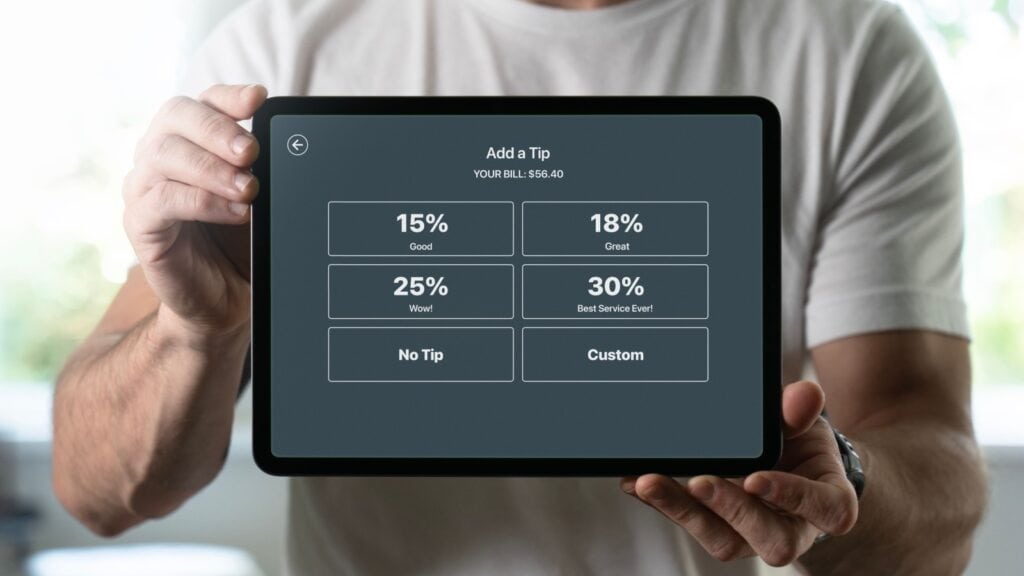

Are We Getting Bullied Into Tipping? When To, How Much And When Not To Tip

It is happening more and more. You are standing in line at a fast food restaurant or coffee shop, the counter person guides you to the point-of-sale machine and there it is, staring at you. Even at self-checkout machines, a screen comes up suggesting that you tip, complete with an array of amounts, sometimes a dollar amount, other times a percentage. Read: Are We Getting Bullied Into Tipping? When To, How Much And When Not To Tip

9 Of The Most Regretted Purchases People Still Regularly Make

Many people regret trying to keep up with the latest trends, whether it’s buying expensive fashion items, fancy gadgets, or luxury cars; the initial excitement often fades quickly, leaving behind feelings of disappointment. It’s essential to focus on what truly brings long-term satisfaction rather than chasing fleeting trends. Let’s take a look at a few trends and costly items that are best avoided. Read: 9 Of The Most Regretted Purchases People Still Regularly Make

Join Us

Join us on this empowering journey as we explore, celebrate, and elevate “her story.” The Queen Zone is not just a platform; it’s a community where women from all walks of life can come together, share their experiences, and inspire one another. Welcome to a space where the female experience takes center stage. Sign up for our newsletter so you don’t miss a thing, Queen!