Can You Protest By Not Paying Taxes? Here’s What You Need To Know

In today’s world of political division and social activism, the idea of refusing to pay federal taxes as a form of protest is making headlines again. It’s not a new concept—people have used tax resistance as a statement against government policies for centuries. But let’s be clear: this approach comes with serious legal and financial risks.

So, what happens if you don’t pay? Is it an effective strategy, or are there better ways to make an impact? In this piece, we’ll look at the real consequences of tax nonpayment, dive into historical and modern examples, and explore alternative ways to use your money as a form of activism—without putting yourself in legal jeopardy.

Legal and Financial Consequences of Tax Nonpayment

Escalating Penalties and Interest

The Internal Revenue Service (IRS) imposes stringent penalties for unpaid taxes, beginning with a 0.5% monthly charge on unpaid balances, capped at 25% of the total debt. Interest compounds daily, currently at 8% annually (as of Q3 2024), further inflating liabilities. For context, a $10,000 tax debt could accumulate over $800 in interest alone within a year.

Enforcement Mechanisms

The IRS employs a graduated enforcement system:

- Automated Collection Systems (ACS): Defaulters receive escalating notices before accounts are flagged for liens or levies.

- Asset Seizures: The IRS can freeze bank accounts, garnish wages, or confiscate property—including homes and vehicles—to recover debts.

- Refund Offsets: Future tax refunds are automatically applied to outstanding balances, even if taxpayers enter payment plans.

Criminal charges, though rare for purely financial nonpayment, may apply if willful evasion is proven. High-profile cases like actor Wesley Snipes’ 2008 conviction (three years for failing to file $7M in taxes) demonstrate the risks of overt defiance.

Historical Precedents of Tax Resistance

Image credit Everett Collection via Shutterstock

Early American Rebellions

Tax resistance shaped foundational U.S. conflicts:

- The Whiskey Rebellion (1791–1794): Pennsylvania farmers revolted against Alexander Hamilton’s liquor excise tax, leading to President Washington mobilizing 13,000 troops to suppress dissent.

- Massachusetts Shays’ Rebellion (1786–1787): Debtor farmers attacked courthouses to protest property seizures, highlighting tensions influencing constitutional reforms.

Philosophical Foundations

Henry David Thoreau’s 1846 refusal to pay a poll tax (protesting slavery and the Mexican-American War) became a touchstone for civil disobedience. His essay Civil Disobedience argued:

“If the injustice is part of the necessary friction of the machine of government, let it go… perchance it will wear smooth.”

Thoreau’s stance influenced Gandhi and Martin Luther King Jr., embedding tax resistance in ethical protest traditions.

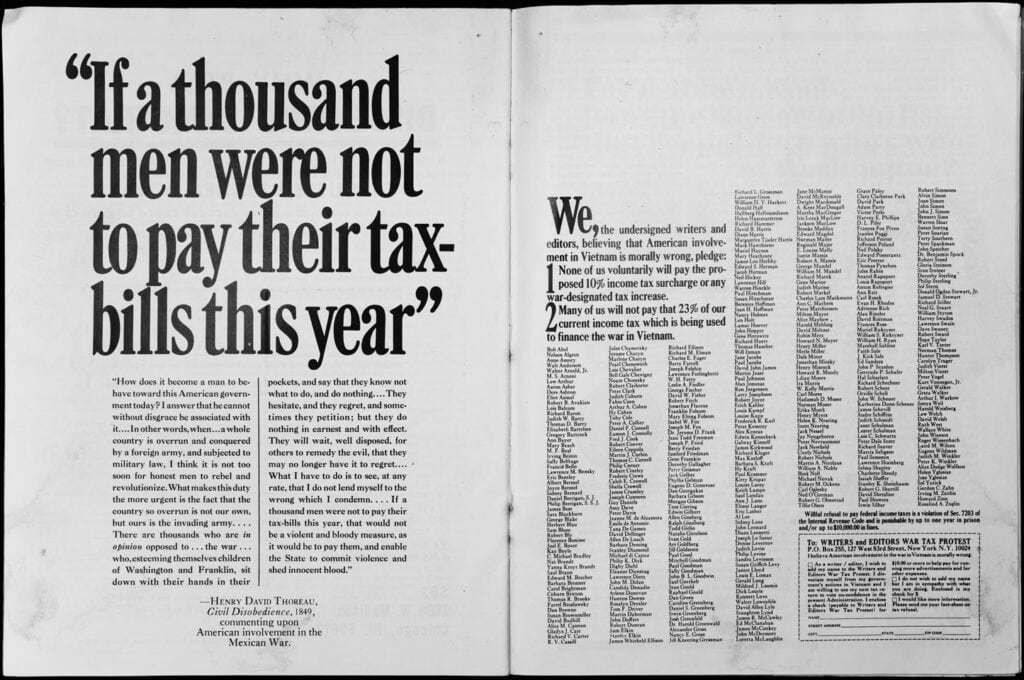

20th-Century Movements

Public Domain

- Vietnam War Era: Over 500,000 Americans withheld taxes or reduced payments by the military budget’s percentage (then ~45%). Folk singer Joan Baez publicly donated withheld taxes to peace charities.

- 1980s Nuclear Freeze Campaigns: Activists redirected “war tax” portions to humanitarian groups, facing IRS liens but garnering media attention.

Modern Tax Resistance Movements

Institutionalized Protest Frameworks

The National War Tax Resistance Coordinating Committee (NWTRCC) guides activists on lawful dissent:

- Symbolic Refusal: Withholding $10.40 (a nod to IRS Form 1040) triggers IRS scrutiny while minimizing penalties.

- Percentage-Based Resistance: Reducing payments by the military budget’s proportion (27% in 2024) links protest to policy critiques.

2024 Campus Protests

Pro-Palestinian demonstrators at Columbia University and elsewhere have drawn scrutiny for donor ties to groups like Jewish Voice for Peace and IfNotNow, funded by progressive philanthropists including the Rockefeller Brothers Fund. While not directly tax-focused, these movements highlight how financial networks amplify dissent—a dynamic mirrored in tax resistance circles.

The Sovereign Citizen Movement

Radical factions, such as followers of Roger Elvick’s “strawman theory,” falsely claim constitutional exemptions from taxes. Courts uniformly reject these arguments, with the Seventh Circuit noting:

“Tax protester assertions are wholly defective and unsuccessful.”

Alternative Financial Activism Strategies

Editorial credit: Ameer Mussard-Afcari / Shutterstock.com

Redirected Tax Payments

Some jurisdictions allow protest payments under legal challenge. Montana’s statute (15-1-402 MCA) permits taxpayers to pay under written protest while disputing assessments—a model activists could adapt for ideological objections.

Ethical Consumerism Campaigns

- Boycotts: The Boycott, Divestment, Sanctions (BDS) movement against Israel has pressured corporations via consumer leverage, avoiding direct tax conflicts.

- Divestment: Universities like Harvard faced student demands to withdraw endowments from fossil fuels, leveraging financial influence without legal risks.

Strategic Litigation

Illinois’ Independent Tax Tribunal allows challenges to specific allocations (e.g., military spending) without full nonpayment. Though rarely successful, such cases generate publicity and pressure legislators.

Conclusion: Weighing Risks and Impact

Tax withholding remains a high-stakes protest method, given the IRS’s robust enforcement capabilities. Historical precedents show mixed efficacy: Thoreau’s stand became iconic, but mass Vietnam-era resistance had limited policy impact. Modern movements face additional hurdles, including automated collections and politicized audits.

Alternatives like targeted boycotts or shareholder activism offer safer avenues for activists seeking tangible influence without legal jeopardy. As the Rockefeller-funded campus protests illustrate, aligning with institutional donors can amplify reach while avoiding personal liability. Ultimately, the choice between symbolic defiance and pragmatic financial activism depends on one’s risk tolerance and strategic goals.

In Thoreau’s words:

“Under a government which imprisons any unjustly, the true place for a just man is also a prison.”

Yet contemporary reformers might find equal power in reshaping economic systems from within—proving that financial protest need not hinge on IRS defiance alone.

You may want to read: This Is How The IRS Knows When You Are Cheating On Your Taxes