13 reasons why retiring too early can kill you

What if the freedom you’re racing toward isn’t liberation at all, but the beginning of a long, uncomfortable drift?

The idea of clocking out for the last time at fifty might sound like the ultimate American dream, but the reality is often much stickier than the fantasy. Many folks find themselves drifting without a schedule, missing the daily grind they thought they hated, and facing unexpected hurdles that turn their golden years into a stressful scramble. The freedom to do whatever you want can quickly curdle into a lack of direction, leaving you wondering if you made a huge mistake by hanging up your hat so soon.

Retiring before you are truly ready can expose you to financial and emotional risks that are hard to recover from once the steady paychecks stop coming in. You might assume your savings are enough to coast on, but inflation and surprise expenses have a nasty habit of eating away at your nest egg faster than you can replenish it. It is crucial to look before you leap, because once you step off that career treadmill, getting back on can be nearly impossible.

Your Savings May Run Out Faster Than You Think

Inflation is the silent killer of early retirement plans, chewing through your purchasing power year after year until your budget barely covers the basics. If you quit working at fifty, you have to stretch your money for potentially forty or fifty more years, which is a math problem that stumps even savvy investors. You can’t predict the market, and a bad decade of returns right after you quit can decimate your portfolio permanently.

Many people underestimate how much life actually costs when every day is Saturday, and you have endless hours to fill with activities. According to Fidelity Investments, a 65-year-old retiring in 2025 can expect to spend an average of $172,500 on health care alone in retirement, a figure that shocks most people. Running out of cash when you are too old to work is a nightmare scenario that happens more often than you would expect.

You Lose Your Primary Source Of Social Interaction

Work is often the glue that holds our social lives together, providing built-in friends and daily conversations that keep us connected to the world. When you leave the office, you lose that automatic network, and suddenly you have to work much harder just to have a simple chat with another human being. It is easy to find yourself sitting at home alone, realizing that your work buddies were just proximity friends who moved on without you.

Loneliness is a serious health risk that can creep up on you when you no longer have a reason to leave the house every morning. A 2024 poll 403from the University of Michigan found that 33% of older adults felt lonely some or all of the time, highlighting how isolation hits hard after a career ends. Staying socially active requires effort, and without the structure of a job, your circle can shrink to zero very quickly.

Your Cognitive Abilities Can Decline Rapidly

Your brain is like a muscle that needs constant resistance and challenge to stay sharp, and a demanding job often provides exactly that kind of mental workout. Without complex problems to solve or new skills to learn, your cognitive processing speed can slow down significantly, leading to that foggy feeling many retirees complain about. Watching TV and doing the occasional crossword puzzle simply cannot replace the mental engagement of a full-time career.

The link between early retirement and brain health is frighteningly real, as the lack of stimulation accelerates age-related decline. The Alzheimer’s Association notes that 1 in 9 people age 65 and older has Alzheimer’s, and staying mentally active is one of the few ways doctors suggest we can fight back. If you don’t have a plan to replace that mental load, you might find yourself losing your edge much faster than your working peers.

Social Security Benefits Take A Major Hit

Claiming your government benefits the moment you are eligible is one of the most expensive mistakes you can make if you live a long life. If you claim Social Security at age 62, you are locking in a permanent 30% reduction in your monthly check compared to waiting until your full retirement age of 67. That is a massive pay cut to accept for the rest of your life just to get out of the workforce a few years early.

Those smaller checks might seem fine now, but they will feel painfully inadequate when you are eighty and inflation has doubled the price of bread. You are essentially betting against your own longevity, and if you live into your nineties, the cumulative loss of money is staggering. Patience pays off here, but early retirees often feel forced to tap this resource too soon just to make ends meet.

The Loss Of Identity Can Be Crushing

We spend decades answering the question “what do you do?” with our job title, letting our careers define who we are and where we fit in society. When that title is gone, you are left staring in the mirror asking, “Who am I?” and the answer is not always easy to find. This identity crisis can shatter your confidence and leave you feeling invisible in a world that prioritizes productivity and status.

You might feel like a “has-been” or struggle to relate to people who are still in the thick of their careers and only want to talk shop. Depression is a common side effect of this loss, with one NIH meta-analysis finding the mean prevalence of depression among retirees sits at 28%. Without the badge of your profession, you have to build a new self-image from scratch, which is heavy emotional lifting.

Boredom Becomes Your New Full-Time Job

The first few months of freedom feel like an extended vacation, but eventually, you run out of closets to organize and shows to binge-watch. You have roughly 2,000 extra hours a year to fill that you used to spend working, and golf or gardening rarely fills that void. Boredom can lead to destructive habits like drinking too much or spending money you don’t have just to feel something exciting.

Most people overestimate how much leisure time they can actually enjoy before they start climbing the walls with restlessness. By late 2024, the National Conference of State Legislatures 403 reported that 20% to 25% of retirees were working part-time or full-time jobs again, proving that endless free time isn’t always cracked up to be. You need a concrete plan for your days, or the emptiness will drive you right back to the classified ads.

Marital Friction Often Spikes

You and your spouse might love each other dearly, but you probably aren’t used to being in the same house twenty-four hours a day, seven days a week. Suddenly, you are under each other’s feet constantly, critiquing how the dishwasher is loaded or arguing over what to eat for lunch. This drastic change in dynamic can expose cracks in the relationship that were previously papered over by time apart.

“Gray divorce” is on the rise for a reason, as couples realize they have grown apart and can’t stand the suffocation of constant togetherness. You need to renegotiate your boundaries and respect each other’s need for space, which is a difficult conversation to have after decades of routine. If you don’t adapt, your dream retirement could end up being a lonely solo act in a separate apartment.

Healthcare Costs Can Bankrupt You

Medicare doesn’t kick in until you are 65, so if you retire at 55, you are on your own for a decade of incredibly expensive health insurance. Private market premiums can cost thousands of dollars a month for a couple, draining your savings before you even reach official retirement age. One serious illness or accident during this gap period can wipe out a lifetime of hard work and prudent saving.

Even with Medicare, the out-of-pocket costs for hearing aids, dental work, and long-term care are enough to make your eyes water. Fidelity’s research shows that 1 in 5 Americans have never even considered healthcare costs in their retirement planning, which is a recipe for disaster. You simply cannot afford to get sick in America without a fortress of cash to protect you.

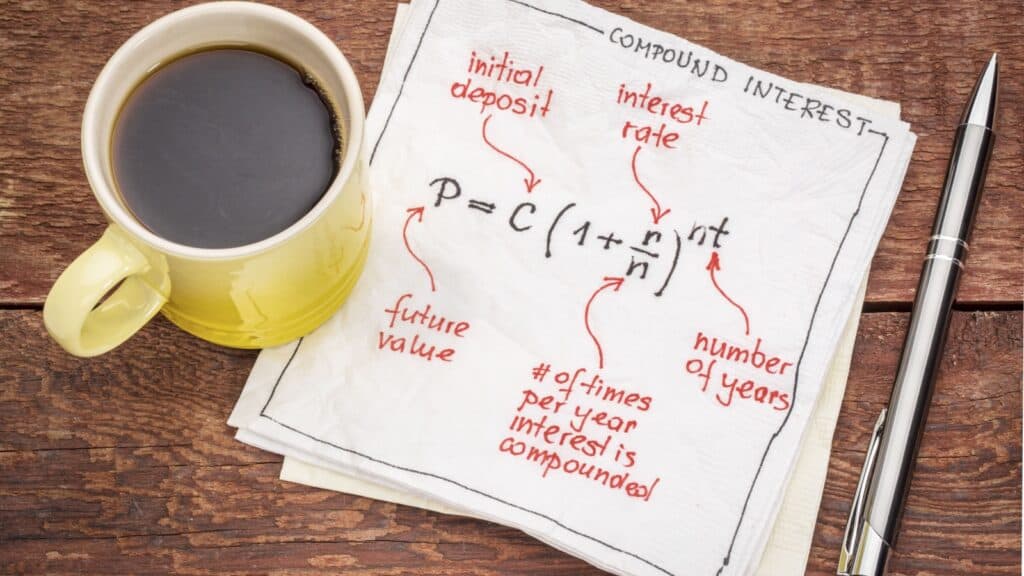

You Miss Out On Compound Interest

The last few years of your career are often your highest earning years, and also the most powerful years for your investment compounding. By pulling your money out early, you interrupt the snowball effect right when it is gathering the most speed and size. You aren’t just losing your salary; you are losing the massive growth that those final contributions would have generated over time.

Walking away from potential company matches and profit-sharing plans is leaving free money on the table that you can never get back. Every year you work allows your portfolio to grow while you leave the principal untouched, creating a much larger safety net for later. Cutting that growth short can be the difference between a comfortable life and a penny-pinching existence.

Returning To Work Is Harder Than You Think

You might tell yourself that you can always go back to work if you need the money, but the job market is not kind to older applicants with resume gaps. Skills become obsolete very quickly in our digital age, and ageism is a rampant, ugly reality that makes it tough to get hired. You might find yourself overqualified for entry-level jobs but viewed as “too rusty” for the senior roles you used to hold.

The idea of “unretirement” sounds flexible, but often the only jobs available are low-paying service gigs that are physically demanding. AARP reports that unemployment for older adults is high, as many struggle to find roles that match their previous status or pay grade. Once you step off the ladder, the rungs have a way of disappearing beneath you.

Physical Health Often Deteriorates

Sitting at a desk is bad, but sitting on a couch for thirty years is arguably much worse for your heart and waistline. Without the routine of commuting and moving around an office, many early retirees settle into a sedentary lifestyle that accelerates physical decay. You have to be incredibly disciplined to maintain a fitness regime when there is no alarm clock forcing you out of bed.

The lack of physical purpose can lead to weight gain, muscle loss, and a host of chronic conditions that lower your quality of life. You might think you will exercise more, but statistics often show that activity levels drop after retirement without the external motivation of a schedule. Your body needs a reason to move, and “because I should” is rarely a strong enough motivator for long.

You Might Outlive Your Friends and Family

Retiring early means you might spend a significant portion of your life as the “old person” while your peers are still busy working and raising families. You fall out of sync with your generation, leaving you with nobody to play with on a Tuesday morning. This temporal mismatch can be incredibly isolating, as you wait around for everyone else to finish their shifts.

As you age, the circle naturally thins out, and starting that process early means more years of witnessing loss and change. It is a heavy psychological burden to be the one with free time while everyone else is occupied with the business of living. Staying in the game keeps you connected to the vibrant, busy energy of life for a little bit longer.

Like our content? Be sure to follow us